Youth Perspectives on Financial Independence

Volume:

April 2025

Contributors:

Tammy Chang, MD, MPH, MS

Marika Waselewski, MPH

Carson Downer

Aamina Hussain

The transition from parental support to financial independence is a major developmental milestone for young people. Successful transition requires developing financial literacy, managing spending, and establishing stable income. This study investigates the challenges youth face, ranging from acquiring confidence in handling their own money to maintaining stable employment. This report describes how young people define financial independence and stability, focusing on factors influencing their path to self-sufficiency and providing insights into their financial aspirations and goals.

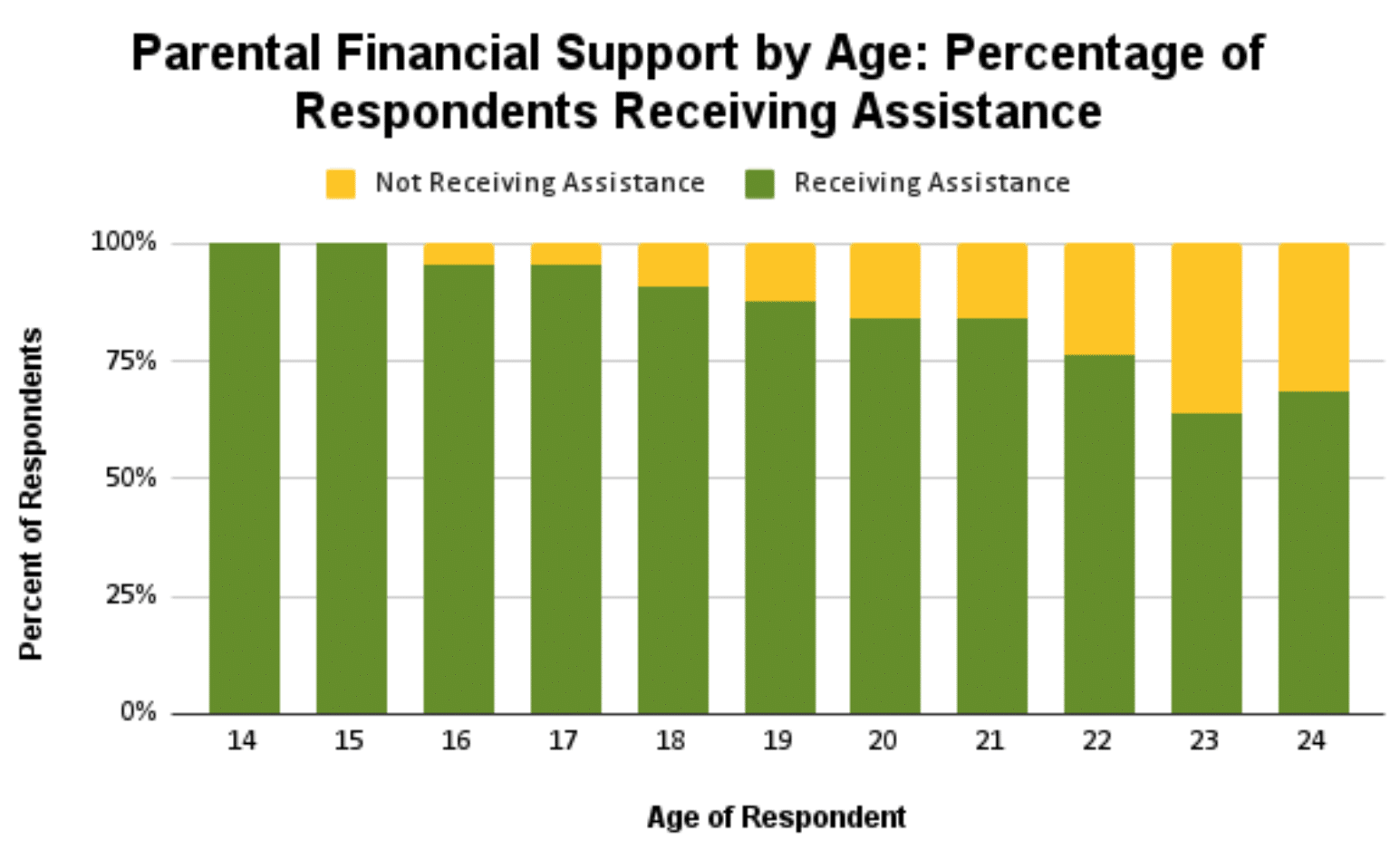

A Majority of Respondents Depend Financially on their Parents

A large majority of youth in our sample (84%) indicated at least some dependence on their parents or guardians to cover expenses. The most commonly supported expenses include food (33%), insurance (32%), housing (30%), and school (27%). One individual shared, “Yes, they help with my rent and groceries, and I am under their insurance.” However, the data shows a decrease in parental financial support as youth age, reflecting a gradual shift toward independence. Among respondents aged 14 to 16 (n=34), 97% reported receiving financial help from their parents, compared to 68% of respondents aged 24 (n=47). Many younger respondents described relying on parents for necessities while older respondents were more likely to cover these expenses themselves. Some noted turning to part-time jobs or other sources of income as they aged. A 16-year-old respondent explained, “Yes, my parents pay for everything but my own personal spending money.” In contrast, a 24-year-old respondent noted, “Sometimes they send me money for bills, but not often.”

“Yes, my parents pay for everything but my own personal spending money.“

Most Respondents Say Financial Stability, Not Age, Should Determine Support

Few respondents (7%) suggested that parental financial support should end at the legal age of 18. Most respondents instead emphasized financial stability as the key determinant for ending support, rather than a specific age. Financial stability was commonly defined as a young person’s ability to live independently, whether through stable employment or major life milestones like marriage. One respondent stated, “Whenever the child can safely support themself,” while another noted, “When their children can live and work on their own without assistance.”

Financial stability was commonly defined as a young person’s ability to live independently … .

Over Half of Respondents Felt Comfortable Managing Their Own Money

58% of respondents reported feeling comfortable managing their own finances, reflecting mixed confidence levels among youth in financial management. Notably, of those who felt comfortable, 38% attributed their confidence to simply being good at saving money or limiting spending. Many respondents framed their comfort as situational or tied to a lack of financial complexity in their lives. One individual explained, “I feel okay managing my own money because I don’t have a whole lot to keep track of but I feel like I could do a better job of budgeting and saving my money.” Among respondents who did not feel comfortable managing their finances, one-third cited a lack of knowledge and experience as the primary barrier. This sentiment was echoed by a respondent who shared, “I feel alright, but there’s a lot of tax and investing stuff I’m still not too familiar with.”

“I feel okay managing my own money because I don’t have a whole lot to keep track of but I feel like I could do a better job of budgeting and saving my money.”

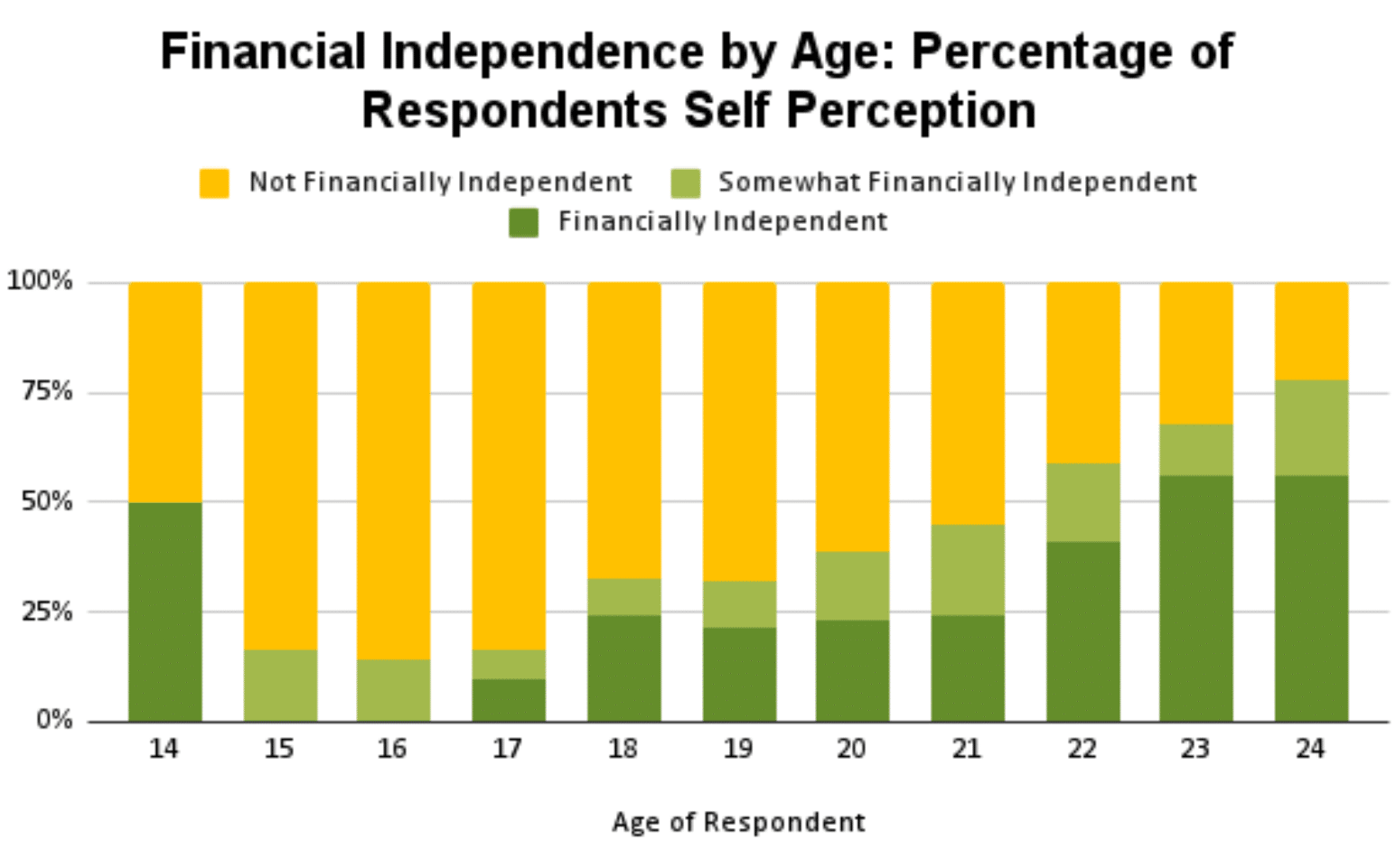

Most Respondents Do Not Consider Themselves Financially Independent

A large majority of the youth in our sample (72%) reported that they do not consider themselves financially independent, with 61% citing reliance on parental or other financial support. One respondent explained, “No, I still depend on my parents for basic things, I don’t earn enough to be independent.” Among the 28% who considered themselves financially independent, half (50%) of these respondents noted that they pay their own expenses. Financial independence was strongly correlated with age, highlighting a gradual transition toward self-sufficiency. While only 7% of respondents aged 14 to 17 (n=94) identified as financially independent, this figure rose to 56% among respondents aged 23 or 24 (n=91). As one 16-year-old stated, “I am definitely not, because I don’t have an occupation and I can’t pay for things on my own.”

“I still depend on my parents for basic things, I don’t earn enough to be independent.”

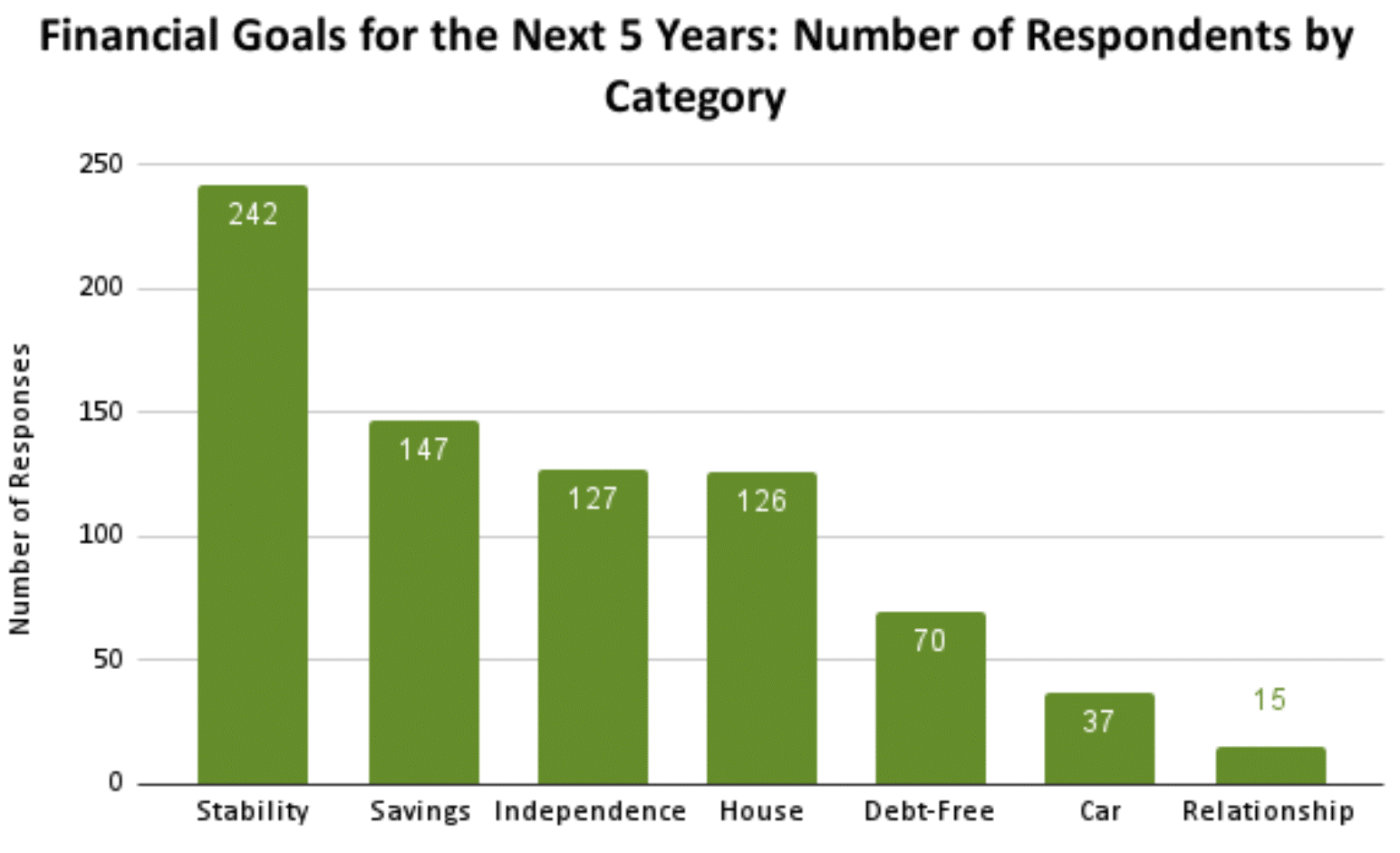

Financial Stability is a Key Part of Respondents’ 5-Year Financial Plans

Nearly half (47%) of respondents identified financial stability as a key financial goal within the next five years, reflecting its importance in their aspirations. Among these respondents, 53% defined financial stability in terms of career or job goals, 17% associated it with freedom from financial worry, and 16% linked it to building net worth. One respondent shared, “In terms of my financial goals, I see myself with a self-sustaining business making 5 figures annually.” Another stated, “I aim to work a part-time job and be pursuing higher education to become a physician.” In addition to financial stability, respondents cited improving savings (29%), securing housing (25%), and achieving financial independence (25%) as key financial objectives.

Implications

The study shows that many young individuals remain financially dependent on their parents/guardians as they transition into adulthood, with most believing support should continue until they are financially stable, rather than until a certain age. Many youth also feel unprepared to manage their finances, underscoring the need for better financial education and resources. Young people identified financial stability, increased savings, and independence as their top financial goals for the next 5 years.

Data Source and Methods

Responses were collected using the MyVoice study, a nationwide text-message poll of youth. Participants were recruited via social media based on weighted benchmarks from the American Community Survey. Questions were iteratively developed by a research team including survey experts and youth, and the following were fielded: 1) Do your parents/guardians currently pay any expenses for you? If yes, what do they help with (school, food, insurance, rent, spending money, etc.)? 2) When do you think parents/guardians should stop supporting their children financially? 3) How comfortable do you feel managing your own money? Why? 4) Do you consider yourself financially independent? Why or why not? 5) What financial goals do you have for the next 5 years? 586 out of 794 youth (RR= 74%) responded to the survey on November 18, 2022. All qualitative responses were analyzed by two independent investigators to reach a consensus.

More information about MyVoice methodology is available at researchprotocols.org/2017/12/e247.

Youth Perspectives on Financial Independence, MyVoice, April 2025, DOI: 10.7302/25293

Volume:

April 2025

Contributors:

Tammy Chang, MD, MPH, MS

Marika Waselewski, MPH

Carson Downer

Aamina Hussain